Pinterest has officially crossed a major milestone: 600 million monthly active users (MAUs) and 17 % year‑over‑year revenue growth in Q3 2025. For marketers, brand leaders, and creator‑economy professionals, this signals both promising upside and important strategic caveats. Below we break down what these numbers really mean, how Pinterest is evolving as a commerce and ad platform, and how your strategy should adapt.

A Snapshot of the Q3 Results

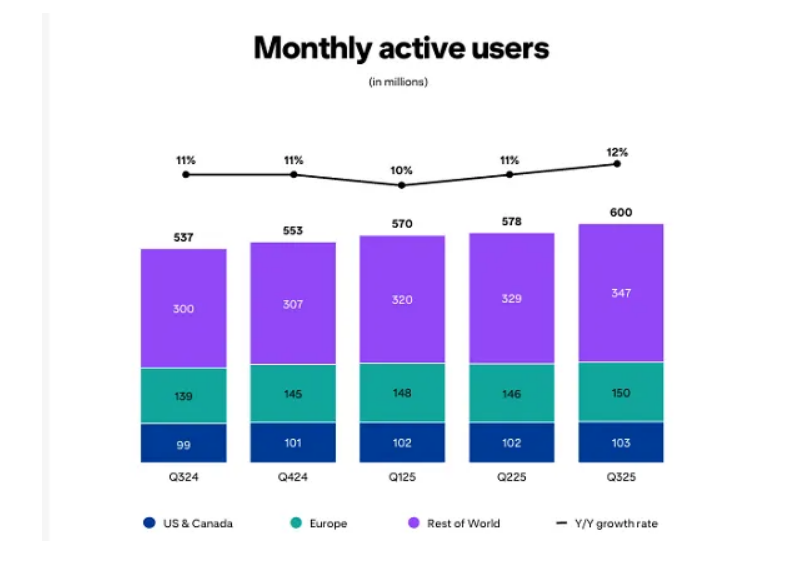

In the quarter ending September 2025, Pinterest reported:

- MAUs of ~600 million, up significantly compared to prior quarters.

- Revenue growth of ~17 % year‑over‑year, indicating improving monetization of its user base.

- Strong international growth, while U.S./Canada growth began to moderate.

- Guidance for Q4 showing revenue between approximately $1.31 billion and $1.34 billion — a healthy number, but slightly below some market expectations.

These figures show that Pinterest is no longer solely a “discovery board” for hobby‑projects; it’s increasingly a serious digital ad platform and e‑commerce enabler.

Why the Growth Matters

1. User Base Expansion

Crossing the 600 million MAU threshold matters on several fronts:

- A larger audience means more potential ad inventory and scale for marketers.

- More users, especially in international markets, help diversify reliance beyond saturated U.S./Canada markets.

- For creators and brands, an expanding user base means more “doors” to reach new audiences via pins, video formats, and shopping features.

2. Revenue Acceleration

Revenue growth of ~17 % demonstrates that Pinterest is becoming more effective at converting user attention into advertiser dollars. That indicates:

- Improved ad formats and performance tools.

- Better targeting or product offerings from Pinterest.

- Growing interest from marketers wanting to tap Pinterest’s “inspiration to purchase” journey.

3. Platform Evolution toward Commerce

Pinterest has long been known for inspiration—ideas, boards, planning. But now it’s evolving:

- More emphasis on shopping, product pins, visual search, and ad formats optimized for purchase intent.

- For brands and agencies, Pinterest offers an environment where intent is higher (users often pin items they plan to buy) compared to pure entertainment platforms.

Strategic Implications for Marketers & Brands

A. Positioning and Ad Strategy

If you’re a brand looking for performance, Pinterest now deserves serious allocation. Consider:

- Running campaigns that match “discovery-to-purchase” journeys—users pin, revisit, click, then buy.

- Testing product promotion using Pinterest’s commerce‑friendly formats.

- Aligning creative with the platform’s strength in visuals, clean layout, idea‑driven content rather than loud, interruptive ads.

B. Creators & Influencers

For creators or influencer networks:

- Consider integrating Pinterest into your channel mix. If you manage multiple creator accounts or commerce‑led profiles, check out programs like the Buy Bulk Pinterest Accounts Guide for scaling.

- Use Pinterest to support long‑tail content: e.g., idea pins, tutorials, boards showcasing niche products. These can drive traffic or conversions across platforms.

- Collaborate with brands to build pins that feed into holiday or seasonal campaigns—Pinterest users often plan ahead, so early activation matters.

C. Agencies & Multi‑Account Ops

For agencies managing brand portfolios or commerce stacks:

- Pinterest’s improving ad tools and user growth mean you should build workflows that incorporate it from the planning phase (not just the “afterthought”).

- Test multiple target audiences, especially internationally, since growth in outside‑US markets is stronger.

- Monitor creative fatigue, retargeting windows, and conversion attribution carefully—Pinterest buyers might behave differently than on impulse‑commerce platforms.

Key Considerations & Challenges

Despite the positive numbers, several caveats remain:

1. Slowing Growth in Mature Markets

While international growth is strong, U.S./Canada markets are showing slowed momentum. For brands heavily focused on North America, this may blunt upside.

- Average Revenue Per User (ARPU) in the U.S./Canada remains higher than other regions but is not growing as fast.

- With more users outside mature markets, the monetization gap between regions widens.

2. Ad Competition & Marketplace Saturation

Pinterest is in fierce competition with Meta, TikTok, and others. As more advertisers pour budget into Pinterest, costs may rise and performance may flatten.

Also, many brands have not yet optimized for Pinterest’s unique user behavior—lack of platform‑specific creative or misaligned targeting could undercut results.

3. Monetization of International Users

While user growth abroad is strong, monetizing those users is harder (lower advertising budgets, less developed commerce infrastructure). Brands should calibrate expectations accordingly.

4. Q4 Guidance Slightly Below Expectations

The guidance range ($1.31‑$1.34 billion) suggests Pinterest sees challenges in holiday ad spend, perhaps due to macro uncertainty or advertiser caution. Brands should be mindful of broader market headwinds (tariffs, supply chain, cost pressures) that could impact results.

How to Plan for Pinterest in Your Marketing Mix

Step 1: Audit Your Creative & Format Fit

- Evaluate whether you have visuals appropriate for Pinterest (high-quality, vertical/idea‑pin friendly).

- Consider “how-to” or inspiration content that aligns with Pinterest’s user mindset.

- Test standard promotional pins vs longer‑form idea pins for engagement and conversion.

Step 2: Time Your Campaigns for Planning Behavior

Pinterest users often plan purchases ahead of time (home décor, weddings, fashion, gifting).

- Launch campaigns earlier than you would on impulse-driven platforms.

- Leverage boards and idea pins to feed into later purchase windows.

- For holiday or seasonal campaigns, start building awareness well in advance.

Step 3: Segmented Targeting

- Use interest targeting, keyword targeting, and lookalikes but tailor them to Pinterest’s discovery‑based structure.

- Consider international markets where growth is strong.

- Allocate a portion of budget to emerging regions but monitor performance closely.

Step 4: Measure More than Clicks

- Track downstream conversions: visits, add‑to‑cart, purchases.

- Monitor how idea pins or boards feed into actual sales.

- Compare long‑tail impact (Pinterest may drive purchases days/weeks after the initial pin) vs instant‑click platforms.

Step 5: Optimize Continuously

- Test different creative lengths, formats (static pins, video pins, idea pins).

- Refresh your asset library regularly—Pinterest values fresh visuals and ideas.

- Monitor ROAS by region and vertical; adjust budget mix accordingly.

Verticals Where Pinterest Has Unique Strength

Certain product categories align particularly well with Pinterest’s discovery‑to‑purchase journey:

- Home décor & renovation

- Fashion & accessories (especially gift/gifting)

- Beauty & personal care

- DIY and craft supplies

- Weddings, events & gifting

- Health & wellness inspiration

If your brand operates in one of these spaces, Pinterest may offer higher conversions and longer shelf‑life for content than platforms built for “scroll and buy now”.

Looking Ahead: What Pinterest Must Focus On

For Pinterest to build on this momentum, several strategic priorities will matter:

- Innovative Ad Products: More dynamic ad formats, stronger shopping integrations, AR/VR/visual search enhancements.

- Global Monetization: Improving ARPU in international markets, building commerce infrastructure, local‑market partner ecosystems.

- Creator Ecosystem & Commerce: Enhancing creator monetization, brand‑creator collaboration, and commerce‑led partnerships.

- Data & Personalization: Using AI to surface ideas and ads that match intent, and improving ad efficiency.

- Holiday & Seasonal Execution: Given that shopping planning often happens earlier on Pinterest, capturing that lead time better than competitors will be key.

Final Thoughts

Pinterest’s Q3 2025 results show a platform increasingly optimized for commerce, inspiration, and visual discovery. Crossing 600 million monthly users and hitting ~17 % year‑over‑year revenue growth are meaningful milestones, especially in a slumping ad‑market environment.

For brands, marketers, and creators, Pinterest should now sit firmly in your strategy—not as a “nice to have”, but as a serious channel. Whether you’re building brand awareness, driving product consideration, or directly selling through visual discovery, the platform offers unique strengths.

If you’re planning multi‑account operations, creator networks, or looking to scale across platforms, it’s worth reviewing options like the Buy Bulk Pinterest Accounts Guide to ensure your infrastructure and strategy are aligned.

In sum: Pinterest is not just growing—it’s evolving. If you meet it with the right formats, timing, and creative, it can play a major role in your marketing mix for 2026 and beyond.